Introduction

Google Ads has emerged as a powerhouse for businesses seeking to promote their products and services online. To ensure the integrity of its advertising ecosystem, Google has implemented robust verification measures, particularly for financial services campaigns. In this blog, we’ll delve into the importance of financial services verification on Google Ads and how it contributes to the success and security of online advertising campaigns.

The Need for Financial Services Verification

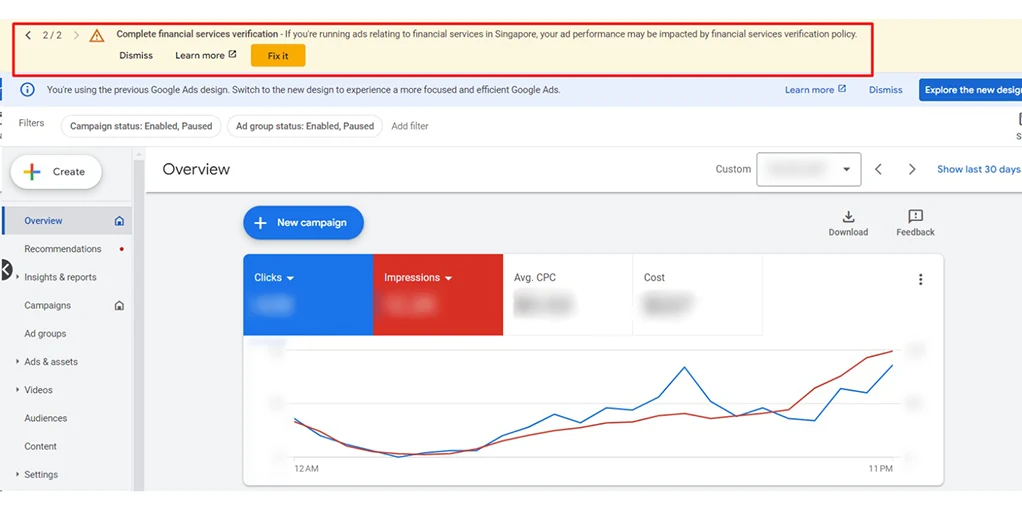

Running campaigns related to financial services requires a heightened level of scrutiny to maintain a secure and trustworthy advertising environment. Google Ads, being a platform with a global reach, aims to protect both users and advertisers from fraudulent activities and misleading content. Financial services verification serves as a crucial step in achieving this goal.

Key Components of Financial Services Verification on Google Ads

- Documentary Verification: Advertisers in the financial services sector are often required to undergo documentary verification. This involves submitting relevant documentation confirming the financial services’ legitimacy and compliance. These documents may include licenses, certificates, or other regulatory approvals.

- Identity Verification: To ensure the identity of advertisers in the financial sector, Google Ads may request additional information, such as the legal entity’s name, address, and contact details. Verifying the identity of advertisers helps maintain transparency and accountability within the advertising ecosystem.

- Compliance with Local Regulations: Advertisers running financial services campaigns must adhere to local regulations and industry standards. Google Ads’ verification process ensures that campaigns comply with these rules, preventing the promotion of potentially harmful or misleading financial products.

- User Protection: Financial services verification on Google Ads ultimately protects users from deceptive or fraudulent advertising practices. By implementing stringent verification measures, the platform aims to provide users with accurate and reliable information, fostering trust in digital advertising.

Benefits of Financial Services Verification on Google Ads

- Credibility and Trustworthiness: Verified financial services advertisers on Google Ads enjoy enhanced credibility and trustworthiness. Users are more likely to engage with ads from verified entities, knowing that they adhere to industry regulations and comply with the necessary standards.

- Mitigation of Fraudulent Activities: Financial services verification acts as a proactive measure against fraudulent advertising practices. By vetting advertisers and their campaigns, Google Ads can identify and prevent potentially harmful content, safeguarding users from scams and misinformation.

- Improved User Experience: Advertisers that undergo thorough verification contribute to an improved user experience. Users are more likely to engage with relevant, trustworthy, and compliant ads that follow industry standards, leading to a positive overall experience on the platform.

Conclusion

Financial services verification on Google Ads is pivotal in maintaining a secure and trustworthy environment in the competitive online advertising landscape. By prioritizing verifying advertisers in the financial sector, Google Ads ensures that users encounter reliable and compliant information, fostering a positive and transparent digital advertising experience. As businesses strive to reach their target audiences through online campaigns, embracing and understanding the significance of financial services verification is essential for success in the ever-evolving world of digital marketing.

To know more about Google Ads, Please visit https://paypercampaign.com/google-ads/